2023 SPAC Outlook

There were 348 SPACs scheduled to expire in 2023 as of February 7, 2023. 92 SPACs holding trust accounts worth over $26 billion (bn) are required to finalise mergers alone in the month of March. Blank check corporations are under a lot of pressure to finish business combinations because of impending expiration deadlines. 19 SPACs with more than $5 billion in trust have already liquidated as of February 7, 2023, as opposed to 0 liquidations during the same period in the previous year. SPACs looking for targets in the technology, media, and telecoms (TMT) sector have accounted for the majority of 2023 liquidations thus far.

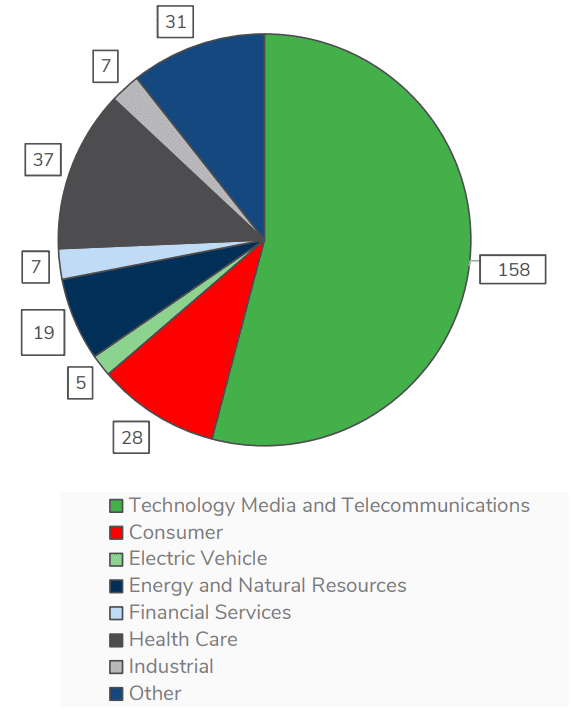

Number of SPACs Looking for Targets by Sector

In 2023, there will still be 158 TMT-focused SPACs with trust values over $40 billion that aim to combine. SPACs will probably have more liquidations in 2023 than in 2021 and 2022 combined, given the existing status of the industry.

With a record number of liquidations in 2022 and an 85% decrease in IPOs from 2021, the SPAC market saw a dramatic downturn in 2022. From $265 million (mn) in 2021 to $156 million (mn) in 2022, the average size of an IPO decreased. In addition, there were 142 liquidations in 2022 as opposed to only one in 2021, and the average redemption rate increased by over 100%. SPACs have several obstacles to overcome, such as tighter regulations, a deteriorating stock market, and rising interest rates. These challenges make the market even more competitive, with over 380 SPACs looking for targets.

SPACs Looking to Achieve a Target Trust Amount by 2023 Expiration (mm)

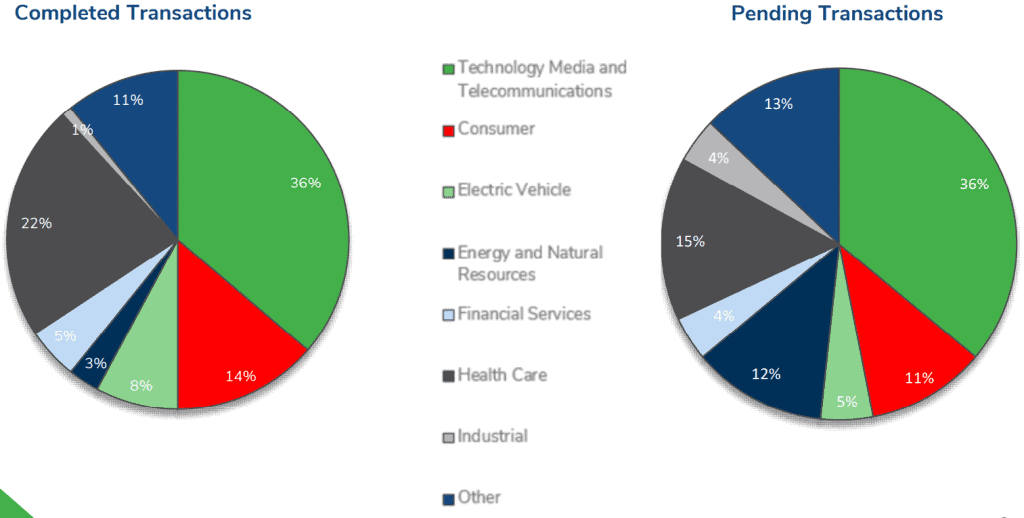

2022 SPAC Market Transaction Activity

2022 Executive Summary: Industry-specific Median De-SPAC Share Percent Return (2009-2022)

Important note:

SPAC Consultants is not offering and/or providing investment advisory services in the sense of regulated investment advisory services as per respective EU Directives and their implementation into national law of EU Member States. Instead, SPAC Consultants offers SPAC Project Management services and consults regarding the general principles of US SPACs and their business structuring. Any investment, legal and financial advice that may become necessary for possible sponsors and investors at advanced stages will be provided by the network partners of SPAC Consultants.

Recent Posts

- Nasdaq approves Breeze Holdings’ acquisition for continued listing to complete a deal by May 28

- AirAsia owner Capital A International is combining with Aetherium acquisition in a $1.15 billion deal

- $60 Million PIPE to Support Zooz Deal is being negotiated by Keyarch Acquisition

- BitFuFu, a Bitcoin mining startup sponsored by Bitmain, intends to go public through a SPAC offering

- Following SPAC merger Bitcoin miner GRIID makes NASDAQ debut