SPAC Acquisition Target Industries 2020-2021

SPAC Acquisition Target Industries and Sectors H2 2020 and Q1 2021

SPACs are focusing on acquisitions with an above-average growth potential. While acquisitions of tech companies represent the biggest piece of the cake, there is still a healthy diversification seen in the acquisition strategies of SPACs. This article analyses SPAC acquisition strategy sectors and sub-sectors of SPACs that launched their IPO during the second half of 2020 and during the first quarter of 2021.

A total of 295 SPACs floated their IPO during the first quarter of 2021, compared with 128 SPACs IPOs during the second half of 2020. To our opinion, in 2021, we will see a total of around 800 – 900 SPAC IPOs in the United States, plus a very few in Europe and even less in Asia. But let us see how the market will develop, how some speculative and over-tuned SPACs will influence the market, and what regulation changes might come up to tame speculators and other wrongdoers. Whatever this year will show, one thing is clear: SPACs are here to stay. At least as long as we continue with quantitative easing, low or negative interest rate and general economic uncertainty. And that means long years to go.

SPAC Acquisition Target Sectors

It is not easy to do a meaningful evaluation and grouping of acquisition target industries, as almost everything today is related to technology. In our evaluation, we put those SPACs into the “Tech” category that explicitly mention in the acquisition strategy “tech company”, “biotech”, “fintech” etc. Where the acquisition strategy of a SPAC included several criteria, we chose the one which seemed to be the main criteria, or which appeared as the most specific area.

While the share of tech companies was 31.25% of all SPACs that launched their IPO in H2 2020 (40 of 128 SPACs), tech companies’ share increased to 46.78% in Q1 2021 (138 of 295 SPACs). It seems that the SPAC frenzy in 2021 did also lead to a frenzy in hunting for even higher growth potential. We did already witness some exaggeration in target company valuations by SPACs, when mature startups with no or very little cashflow were appreciated at a billion dollar and more. Such “hyper-valuations” will make it difficult for the target company to deliver accordingly, once taken public by through merger with a special-acquisition company.

The second largest group of acquisition target industries or sectors in both H2 2020 and Q1 2021 comprises sectors that we commonly names as “Social”. This group includes acquisition target sub-sectors that have a focus on dealing with people of having a direct impact on people through technology, such as “Consumer, Consumer Goods”, “Energy”, “ESG” (meaning target companies with a focus on Environmental, Social, and Corporate Governance, which could be from any industry), “Financial Services “, “Hospitality, Leisure, Travel, Dining, Gaming”, “Mobility” and “Sustainability”.

This group of target industries had a share of 26.56% in H2 2020 (34 of 128 SPACs), which then sized down to 19.32% in Q1 2021 (57 of 295 SPACs).

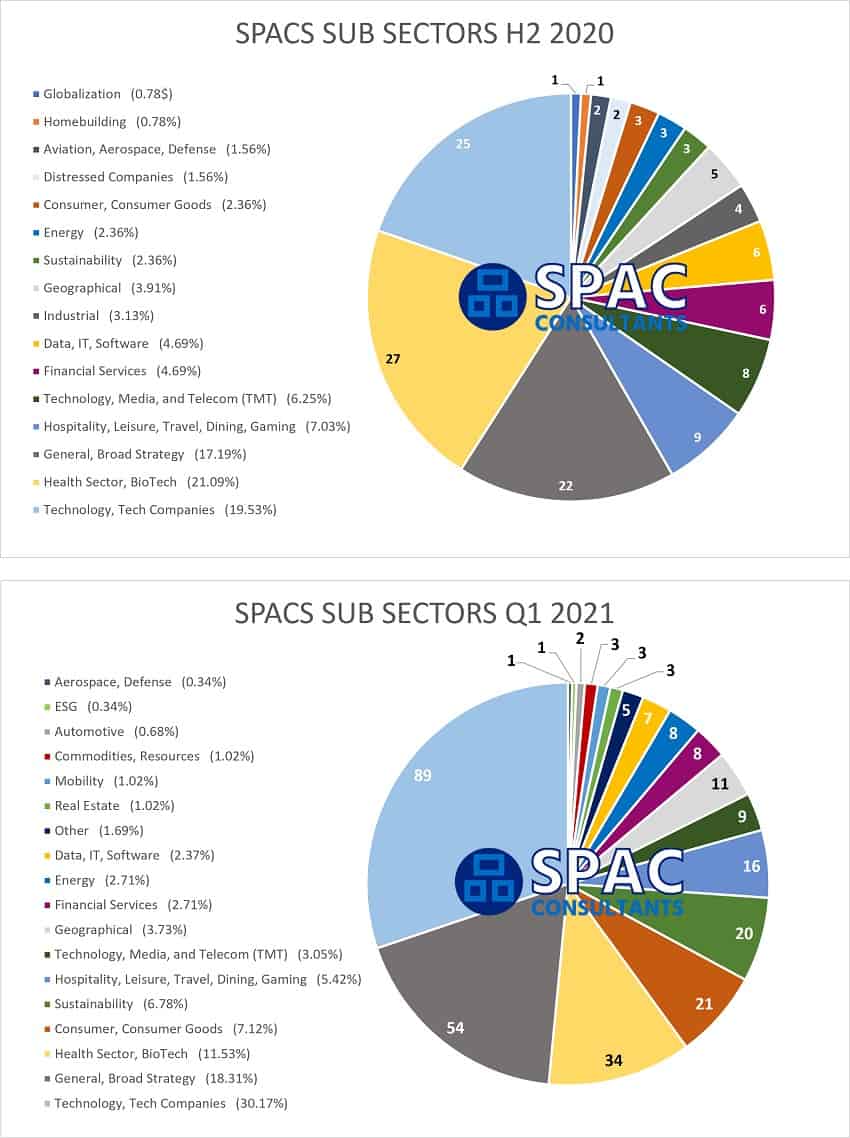

The third largest share in both H2 2020 and in Q1 2021 goes to SPACs that did define their acquisition strategy in their Registration Statement (S-1) filed with the Security Exchange Commission in a very general and broad way not allowing a conclusion that would lead to any specific industries. The share of the group “General, Broad Strategy” is 17.19% in H2 2020 (22 of 128 SPACs) and, almost unchanged, 18.31% in Q1 2021 (54 of 295 SPACs).

The sector group “Others” includes all those sectors with a share of 2% or less.

SPAC Acquisition Target Sub-Sectors

As perhaps to be expected, technology and tech companies take a big piece of the cake, namely 19.53% in in H2 2020 (25 of 128 SPACs) and 30.17% in Q1 2021 (89 of 295 SPACs).

However, we separated Biotech companies. Although biotech companies are still tech companies, they form the largest part of tech companies in general and thus we gave them their own piece of the cake. The sub-sector “Health Sector, Biotech” does also include a few acquisition strategies that focus on health care. During H2 2020, the sub-sector health and biotech took a share of 21.09% (27 of 128 SPACs), and in Q1 2021 a share of 11.53% (34 of 295 SPACs).

FinTech companies in the focus of SPAC acquisition strategies, which are not mentioned separately in our evaluation, took a share of 4.65% with just 6 SPACs in H2 2020, and a share of 6.05% with 18 SPACs in Q1 2020. This just mentioned because we often hear that Fintechs are the darling of SPACs.

We actually love to see that increase of the focus on Fintechs and would love to see an increase in SPACs focusing on financial services. Fintechs are the technologies that will disrupt financial services, and re-organisation of financial services is a way of making banking easier for everybody, and a way of more banking democracy, providing better banking access to the under-banked.

The increase of SPACs with an acquisition strategy focusing on consumers and consumer goods is interesting, to our opinion. While 2.36% of the SPACs during H2 2020 focused on this topic, we see 7.12% of the SPACs in Q1 2021. These SPACs will focus on consumer behaviour, related mass data and its utilisation for the refinement of marketing strategies and tools.

Interesting is also the geographical focus of some SPACs, most of them not even mentioning any specific industry. In 2020, two SPACs mentioned in their acquisition strategy that they are focusing on Asia, and one SPAC each focuses on Mexico, Brazil, and Europe. In 2021, the geographical distribution was as following: two SPACs focusing on Africa (both with ESG as secondary criterion), one on Asia, one on Brazil, two on China, two on Europe and North America, one on the EMEA region, one on North America, and one SPAC mentioned that it focuses on anywhere outside of the US.

Source of base data for this article: SPAC Insider.

Conclusion

Technology and tech companies are paving the way to our future. The entire tech development is just at its beginning, areas like Mass Data, AI, Fintech, or Biotech, to name a few, will disrupt things as we did them until now (or yesterday) and will form new ways to deal with things, improving our lives. It is therefore only natural that technology and tech companies represent the lion portion of all SPAC IPOs. The expectable growth potential further adds to the interest of SPACs in technology and tech companies.

On the other hand, we love the diversification of SPAC acquisition strategies, allowing companies other than only tech companies to go public and to get access to funds for their projects and ambitions. It is creating hope for our future that topics like Environmental, Social, and Corporate Governance (ESG), Sustainability, Healthy Living and Education took already place among the many focuses of SPAC acquisition strategies.

Never in history have so large private funds been provided to the economy and to companies in such a short period. If not misused but structured and invested professionally, SPACs are and will be one of the driving powers of economic, technologic, and social development.

Shanda Consult has been working with SPACs for many years, and our network of SPAC executives has deep experience in the sector. If you need to learn more about how to successfully use a SPAC structure and perhaps wish to set up your own SPAC, we are here to help.

Please contact us with any questions you may have.

Nicosia, Cyprus, April 02, 2021.

Important note:

SPAC Consultants is not offering and/or providing investment advisory services in the sense of regulated investment advisory services as per respective EU Directives and their implementation into national law of EU Member States. Instead, SPAC Consultants offers SPAC Project Management services and consults regarding the general principles of US SPACs and their business structuring. Any investment, legal and financial advice that may become necessary for possible sponsors and investors at advanced stages will be provided by the network partners of SPAC Consultants.

Recent Posts

- Nasdaq approves Breeze Holdings’ acquisition for continued listing to complete a deal by May 28

- AirAsia owner Capital A International is combining with Aetherium acquisition in a $1.15 billion deal

- $60 Million PIPE to Support Zooz Deal is being negotiated by Keyarch Acquisition

- BitFuFu, a Bitcoin mining startup sponsored by Bitmain, intends to go public through a SPAC offering

- Following SPAC merger Bitcoin miner GRIID makes NASDAQ debut