SPACs Appear COVID-19 Resistant

SPACs Appear COVID-19 Resistant

While markets and companies are struggling from lowest levels since years and regular IPOs are consequently down to record lows, the SPAC World seems to be solid and runs from record to record this year. After SPACs hit a new record with 59 IPOs in 2019, 22 SPAC IPOs were successfully floated in 2020, until May 5. Nine of them took place during the lock-down crises since April 1, while the number of regular IPOs was only four during that period.

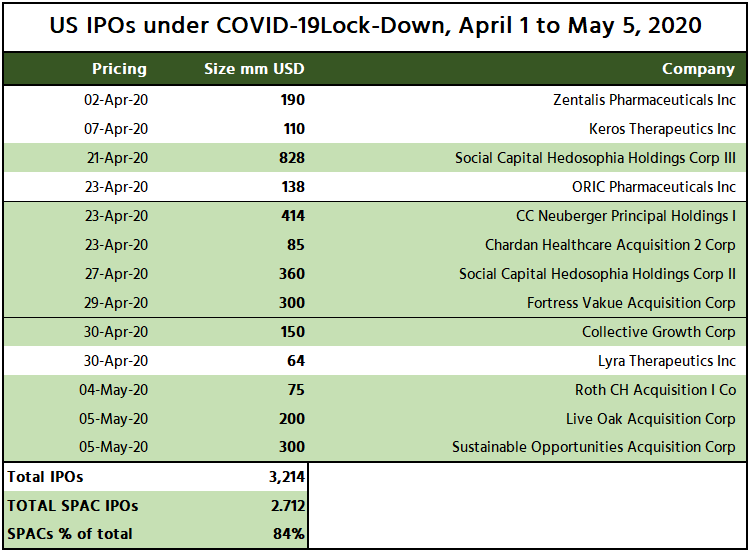

SPAC IPOs during the lock-down period between April 1 and May 5 raised around USD 2.7 billion, accounting for 84% of all US IPOs during that period. In other words, the IPO market would have plummeted without SPACs.

The 84% IPO share of SPAC IPOs during the lock-down period compares with a share of SPAC IPOs of 34% during Q1 2020, when SPAC IPOs raised USD 3.7 billion, being SPACs’ typical share of the IPO market since the last few years.

It is really refreshing and providing hope to see that at least some people and companies are working and heading forward, instead of sitting down in lethargy and applying the “let’s wait and see” philosophy.

Hopefully, those successful SPAC IPOs during the virus lock-down will stimulate entrepreneurs and investors to go ahead with their SPAC projects or SPAC investment intentions.

COVID-19, an Opportunity for SPACs, SPAC Sponsors and Institutional Investors.

Special Purpose Acquisition Companies are currently one of the very few viable investment opportunities for investors unless you are a short-term speculator. With their combination of shares and warrants forming one unit, SPACs are attractive for pre-IPO investors (sponsors) and institutional IPO investors alike. The warrants create substantial upside for sponsors and IPO investors when a successful business combination (acquisition and merger) takes place.

Institutional investors, mainly large pension funds and sovereign funds, had to liquidate billions of stock and other liquid investments to avoid further eroding of their funds. The sales rush effected stock markets and even the gold market badly. Meanwhile, pension funds started to purchase gold for risk hedging reasons, based on current expectations for a gold price hike.

But still, the large pension and sovereign funds are all sitting on mountains of cash, desperately looking for lucrative investment opportunities.

For SPACs, the time could not be better than now. The global virus crises put many companies in serious difficulties, many of them being expected to face bankruptcy. This is in favour of SPACs post-IPO acquisitions, with the outlook to acquire distressed companies’ shares for less value than expected during the SPAC planning phase. SPAC sponsors and IPO investors will like this additional leverage of their investments.

The following table gives an overview of US IPOs during the lock-down period April 1 to May 5. SPAC IPOs are marked green.

Great SPAC Success Stories

As in other industries, great success stories have a positive impact on the market and investors’ behaviour. The acquisition of Virgin Galactic in October 2019 by the Special Purpose Acquisition Company Social Capital Hedosophia of Chamath Palihapitiya did draw the attention of many investors who were unaware of the opportunities SPACs may create for sponsors, especially the attention of private equity funds.

Chamath Palihapitiya floated the IPO of his Social Capital Hedosophia Holdings Corp. III SPAC on April 21, which raised USD 828 during its IPO. Institutional investors believe that Chamath Palihapitiya will land a great deal again, as he did with Virgin Galactic.

There are other important acquisitions that get into the news, of course. The SPAC VectoIQ Acquisition Corp recently announced a deal to acquire of the US high-tech Nikola Corporation, a developer and producer of battery-electric and hydrogen fuel-cell electric vehicles, focusing on trucks, the Nikola Tre model, which is also suitable for European markets, shown above. The industry and investors alike see Nikola Corporation as the Tesla of commercial vehicles. VectoIQ’s current share price has more than doubled since its IPO, although the acquisition has only be announced but not yet materialised.

Key Reasons for SPACs

Getting public through a regular IPO is a lengthy and expensive journey, which is based on the hope that investors will buy the shares publicly offered. Typically, it needs a good 1.5 years until a company gets listing and IPO preparations done, compared with SPACs, that get their IPO typically within three to five months. While a normal IPO costs 10 to 12% of the IPO proceeds, SPAC IPOs can be done for around 6 to 8% of the IPO proceeds. Often, underwriters and other service providers involved agree to get a good part of their discount (fees) after a successful acquisition, while for normal IPOs, all costs are to be fully paid upfront. That creates confidence on the sponsors’ side, who are ensured that underwriters and other service providers will work toward the success of a SPAC, even after its IPO.

SPACs use to get listed and have their IPO after the SPAC management received investment commitments from institutional investors for the SPAC’s IPO. That results in a very short period of a few days only during which the envisaged IPO proceeds get raised.

SPACs are a relatively safe but lucrative investment for institutional investors as IPO proceeds are kept on trust account. Institutional investors have the right to pull out if they do not like the announced acquisition of a SPAC. In such a case, underwriters and the other service providers involved in a SPAC will typically replace the departing institutional investor with new ones.

Sources: Nasdaq, NYSE, Spac Research, Spac Insider, IPO Edge.

Talk to SPAC Consultants for More Information!

Sponsoring a SPAC can be a great investment, but it takes professionals to make the entire SPAC process a success. If you are interested in learning more about how we can help you sponsor a SPAC, or if you want to invest in a SPAC, we can help.

SPAC Consultants has deep connections in the investment banking industry, and we know how to get the most out of a SPAC for everyone who is involved. We are happy to talk to you, your investment team, or your company about what SPACs have to offer investors and potential sponsors!

Important note:

SPAC Consultants is not offering and/or providing investment advisory services in the sense of regulated investment advisory services as per respective EU Directives and their implementation into national law of EU Member States. Instead, SPAC Consultants offers SPAC Project Management services and consults regarding the general principles of US SPACs and their business structuring. Any investment, legal and financial advice that may become necessary for possible sponsors and investors at advanced stages will be provided by the network partners of SPAC Consultants.

Recent Posts

- Nasdaq approves Breeze Holdings’ acquisition for continued listing to complete a deal by May 28

- AirAsia owner Capital A International is combining with Aetherium acquisition in a $1.15 billion deal

- $60 Million PIPE to Support Zooz Deal is being negotiated by Keyarch Acquisition

- BitFuFu, a Bitcoin mining startup sponsored by Bitmain, intends to go public through a SPAC offering

- Following SPAC merger Bitcoin miner GRIID makes NASDAQ debut