The Latest SPAC News

Follow the latest news on the SPAC Market

SEC Listings – IPOs – Acquisitions – Business Combinations

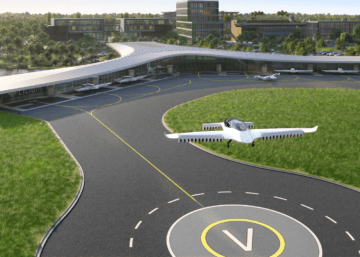

Bavaria-based air taxi Lilium plans to list on Nasdaq via SPAC

2021/03/31

Weßling, Germany-based Lilium has announced their intentions to list on Nasdaq via a merger with SPAC Qell Acquisition Corp.. Transaction values of the combined company top out at a $3.3 billion pro forma equity value at the $10.00 per share PIPE price valuation.

Online payments company Paysafe going public in SPAC merger

2021/03/30

London-based online payments company Paysafe is set to begin trading on U.S. public markets after merging with SPAC Foley Trasimene Acquisition II Corp, billionaire business and sports executive Bill Foley told CNBC Monday.

Car-Seller Cazoo Eyes SPAC Deal at $7 Billion Valuation

2021/03/29

Second-hand car seller Cazoo is finalizing the details of a merger with Ajax I, a special purpose acquisition company, that would see it go public with a valuation of about $7 billion.

Hong Kong Is Set to Target First SPAC Listing by End of Year

2021/03/29

Hong Kong is expected to have its own blank check company listing framework ready in June for public feedback and targets allowing deals to start by the end of this year.

First SPAC in Scandinavia Has Institutional Funds Piling In

2021/03/26

Scandinavia’s first special purpose acquisition company was “considerably oversubscribed,” as institutional investors lined upto commit funds to the blank check vehicle. ACQ, a SPAC created by Swedish investment firm Bure Equity AB, started trading on Thursday.

British electric vehicle firm Arrival sinks in SPAC debut

2021/03/26

British electric vehicle manufacturer Arrival finalized its merger with CIIG Merger Corp, a SPAC set up by former Marvel CEO Peter Cuneo, on Wednesday. It’s now worth roughly $13 billion, up from a valuation of $5.4 billion in November.

FT Partners closes $500m Spac

2021/03/24

Steve McLaughlin, the founder and CEO of financial technology-focused investment banking firm FT Partners, has joined forces with Gene Yoon, the founder of PE firm Bregal Sagemount, to form a $500 million fintech Spac.

When It Comes to Space Company IPOs, You Must SPAC It

2021/03/23

Almost 248 SPACs filed for IPO last year, going public with the sole intent of finding a hot private company to buy and bring public in a reverse merger. Not even one full quarter into 2021, we’ve already seen nearly as many SPAC IPOs this year as last year.

Israeli SPAC Keter1 files to raise $250m on Nasdaq

2021/03/22

Israeli special purpose acquisition company (SPAC) Keter1 Acquisition Corp. has filed with the US Securities and Exchange Commission (SEC) to raise $250 million on Nasdaq for investment in a merger with an Israeli tech company.

Thoma Bravo SPAC Agrees to Take IronSource Public

2021/03/22

Thoma Bravo’s SPAC has reached an agreement to take app software company ironSource public through a merger that values the combined business at $11.1 billion.

Billionaire Scores 3,000% Gain Through Electric-Vehicle SPAC

2021/03/19

In November, Denis Sverdlov’s electric vehicles company, Arrival Ltd. has merged with CIIG Merger Corp., a SPAC, led by Peter Cuneo, the former chief executive officer of Marvel Entertainment. Arrival, is now worth $15.3 billion, more than double its valuation at the start of last year.

German Flying Taxi Startup Volocopter Mulls SPAC, New Funds

2021/03/19

According to Florian Reuter, the chief executive officer of Volocopter, the company will be turning to investors for another infusion of cash after raising $240 million earlier this month. The startup is also considering filing for a public offering, possibly via a SPAC.

eToro Nears $10 Billion Merger With Betsy Cohen SPAC

2021/03/17

Trading platform EToro, a rival to Robinhood Markets Inc., plans to go public via a merger with a SPAC led by serial dealmaker Betsy Cohen. The agreement with FinTech Acquisition Corp. V values the combined company at about $10.4 billion.

Deutsche Bank Rides SPAC Boom to Make League Table Comeback

2021/03/17

Deutsche Bank, which cut back its equities team in 2019, has risen in the league tables over the past few quarters and now ranks 10th globally among advisers on initial public offerings. Special purpose acquisition companies (SPACs) are a big part of that success.

Ex-Commerzbank CEO Plans Fintech SPAC Listing

2021/03/16

A SPAC backed by Martin Blessing, Commerzbank AG’s former chief executive officer, plans to list in Amsterdam and target investments in financial services and technology companies.

Private equity firm’s second SPAC H.I.G. Acquisition II files for a $300 million IPO

2021/03/16

H.I.G. Acquisition II, the second SPAC formed by H.I.G. Capital targeting TMT or healthcare, filed on Monday with the SEC to raise up to $300 million in an initial public offering.

The Miami, FL-based company plans to raise $300 million by offering 30 million units at $10.

SPAC Springwater Special Situations files for a $150 million IPO

2021/03/12

Springwater Special Situations, a SPAC led by the founder of Springwater Capital, filed on Wednesday with the SEC to raise up to $150 million in an initial public offering.

The New York, NY-based company plans to raise $150 million by offering 15 million units at $10.

Acme Solar eyes US listing through SPAC route

2021/03/12

India’s largest pure-play solar platform Acme Solar Holdings Ltd is exploring a US listing through the special purpose acquisition company (SPAC) route, and has held preliminary discussions with Citibank and Credit Suisse.

Another SPAC is gearing up to go public, this time coming from Oleg Nodelman’s EcoR1 Capital

2021/03/11

EcoR1 Capital returning to the reverse-merger market, with Oleg Nodelman’s firm submitting its SEC paperwork Tuesday to the tune of an estimated $150 million raise. Called Panacea Acquisition II, will be EcoR1’s second SPAC to go public over the last nine months after the first Panacea launched last June.

Special Purpose Acquisition Company: What Is A SPAC?

2021/03/10

SPACs are a way for companies to make the leap from privately held to publicly traded in a way that’s often less complicated than an initial public offering (IPO). SPACs are giving management and boards of companies more options for quicker and more efficient ways to go public.

Crowd-Safety Company Evolv Going Public in $1.7 Billion SPAC Merger

2021/03/08

Evolv Technology is combining with a special-purpose acquisition company to go public in a deal that values the crowd-safety firm at about $1.7 billion. Backed by investors including Microsoft Corp. co-founder Bill Gates and former Florida Gov. Jeb Bush, Evolv is merging with the SPAC NewHold Investment Corp.

Singaporean-led Arrow Capital co-sponsors US$240m SPAC with US venture firm

2021/03/08

ARROW Capital, an advisory founded and led by Singaporean Rohit Nanani, has co-sponsored a US$240 million special purpose acquisition company (SPAC), in partnership with US-based venture firm Tribe Capital.

Vista in Talks to Add DealerSocket, Omnitracs to Solera SPAC Deal

2021/03/05

Vista Equity Partners is in talks to add two portfolio companies to its deal for Solera Holdings Inc. to go public through a merger with SPAC Apollo Strategic Growth Capital. The portfolio companies that Vista would combine with Solera are DealerSocket Inc. and Omnitracs. The expanded deal would be valued at about $15 billion.

InsurTech Firms Take SPAC Path To Wall Street

2021/03/05

Hippo Enterprises is going public via SPAC. The Wall Street Journal reported that the firm will go public with Reinvent Technology Partners, in a deal that values the InsurTech at $5 billion.

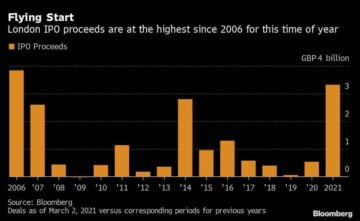

London to Join SPAC Boom in Post-Brexit Market Overhaul

2021/03/04

The U.K. is to reform stock exchange rules around blank-check firms as part of wide-ranging reforms to boost the attractiveness of London after Brexit. Company founders will also be able to keep greater control when they list their businesses in the city.

FORMER SONIC CEO CLIFF HUDSON STARTS A SPAC

2021/03/04

Do It Again, a special purpose acquisition company (SPAC), filed to raise $125 million in an initial public offering. The people behind the SPAC feature a bunch of people with restaurant industry experience, led by its chairman and CEO, Cliff Hudson—who held those titles for Sonic before its 2018 sale to Inspire Brands.

BILLIONAIRE KEN MOELIS, SUPER BOWL CHAMP NDAMUKONG SUH HEADLINE FRESH SPAC DEALS

2021/03/03

Banker Ken Moelis has filed for three new SPACs today, seeking to raise $1.2 billion total to find targets in sectors including sports betting and online gaming, according to prospectuses filed with the Securities & Exchange Commission. It’s part of a fresh wave of sports-related deals starting the week.

Mideast Spotify Challenger Anghami Nears SPAC Merger

2021/03/03

Anghami, the Abu Dhabi-based music-streaming service that claims over 70 million users, is close to being listed on the Nasdaq stock exchange in New York by merging with a SPAC, setting the stage for one of the biggest investments into a Middle Eastern technology startup in years.

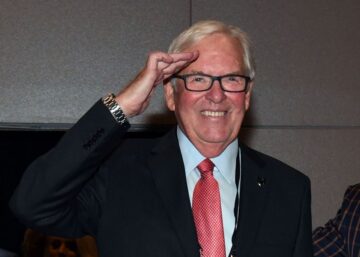

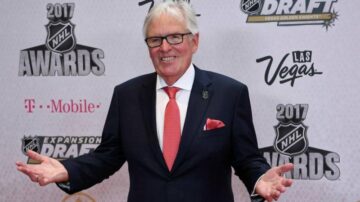

Serial Dealmaker Bill Foley Looks for Carveouts With New SPAC

2021/03/02

Bill Foley, one of the highest-profile names in SPAC dealmaking, is on the lookout for public company assets that it could take public as a separate business. One of Foley’s two newest SPAC which raised $2.07 billion combined last week, is reaching beyond his typical scope for transactions.

SoftBank-backed SPAC chops IPO size to $280m

2021/03/02

SVF Investment Corp. 3, a SPAC backed by SoftBank Group Corp, cut the size of its initial public offering to $280 million from $350 million. The special purpose acquisition company (SPAC) said it would now sell 28 million units, comprising shares and warrants, priced at $10 apiece in its IPO.

New World’s Adrian Cheng Plans Up to $400 Million SPAC

2021/03/01

New World Development Co.’s Adrian Cheng is planning to raise funds through a SPAC in the U.S., making him the latest Hong Kong tycoon to jump on the blank-check firm bandwagon.

Cheng is working with advisers on the potential SPAC’s initial public offering which could raise $200 million to $400 million.

Rocket Lab nears merger deal with a SPAC to go public

2021/03/01

Rocket Lab USA is nearing a deal to go public through a merger with a special-purpose acquisition company Vector Acquisition that would value the small-satellite launch firm at $4.1 billion, including debt, the Wall Street Journal reported.

Goldman-Backed ReNew Power Agrees To Merge With RMG II SPAC

2021/02/26

ReNew Power, India’s biggest renewable power producer, has agreed to merge with SPAC RMG Acquisition Corp. II.

The deal will give Goldman Sachs Group Inc.-backed ReNew an enterprise value of $8 billion and will close in the second quarter.

Quantum computing startup IonQ rumored to be close to $2bn SPAC merger

2021/02/26

The quantum startup and special purpose acquisition company dMY Technology Group Inc. III are close to announcing a deal worth an estimated $2 billion. Existing IonQ investors are expected to roll their equity into the transaction.

Gaw Capital Said to Weigh $200 Million SPAC for Asia Tech Deals

2021/02/25

Gaw Capital Advisors is considering raising at least $200 million through a special purpose acquisition company in the U.S.

The buyout firm plans to set its sights on technology firms in Asia for targets of the proposed blank-check company.

Air Taxi Startup Joby To Go Public In Merger With SPAC From LinkedIn

2021/02/25

The California startup Joby Aviation, one of the leaders in the race to field an electric air taxi, will go public through a reverse merger with Reinvent Technology Partners, a $690 million, publicly listed blank check company controlled by LinkedIn cofounder Reid Hoffman and Zynga founder Mark Pincus.

Churchill Capital Corp IV plunges 48% after Lucid Motors strikes SPAC deal to go public with a $24 billion valuation

2021/02/25

Churchill Capital IV fell as much as 48% on Tuesday after Lucid Motors struck a deal to go public via the SPAC. The deal will generate $4.4 billion for Lucid, which plans to use the funds to expand its Arizona facility. Churchill’s transaction values Lucid at about $24 billion at the PIPE offer price of $15.00 per share.

SPAC Starboard Value Acquisition stock soars after $3.4 billion merger deal to take Cyxtera public

2021/02/24

Shares of Starboard Value Acquisition Corp. soared 16.8%, after the special purpose acquisition company announced a merger agreement that would take data center company Cyxtera Technologies Inc. public, which implies an enterprise value of $3.4 billion.

Electric chassis maker Xos Trucks agrees to $575M SPAC merger

2021/02/24

Electric truck chassis maker Xos Trucks is going public with blank check backing from a special purpose acquisition company (SPAC). Xos will merge with NextGen Acquisition Corp. at an implied market capitalization of $2 billion.

Precision medicine in AMD: SPAC merger sees Gemini make its public debut

2021/02/24

Precision medicine-focused Gemini Therapeutics has completed a business combination transaction with Foresite Capital’s special purpose acquisition company (SPAC) FS Development Corp (FDSC).

Chewing Gum Billionaire Beau Wrigley To Take Cannabis Company Public Through SPAC Deal

2021/02/23

William “Beau” Wrigley Jr. is taking his cannabis company Parallel public on a Canadian exchange by merging with a company backed by music industry entrepreneur Scooter Braun.

Electric Truck Startup Xos Going Public In $2 Billion SPAC Deal

2021/02/23

Xos Inc., a North Hollywood, California-based manufacturer of large electric commercial vehicles, will go public by merging with the blank check firm NextGen Acquisition Corp. in a deal valuing Xos at $2 billion.

Fintech Firm Apex Clearing Agrees to Go Public Via SPAC

2021/02/22

Apex Clearing Corp., a financial technologies firm that focuses on securities custody and clearing, has agreed to go public through a merger with the SPAC Northern Star Investment Corp. II.

The transaction, which could be announced as early as Monday, will be valued at $4.7 billion.

Starboard SPAC Nears $3.4 Billion Deal for Data-Center Company Cyxtera

2021/02/22

Starboard Value Acquisition Corp’s special-purpose acquisition company is discussing a merger deal with Cyxtera Technologies Inc that would value the data-center provider at around $3.4 billion including debt.

Former Disney executives Mayer and Staggs plan new SPAC

2021/02/19

Former Walt Disney Co executivesKevin Mayer and Thomas Staggs plan to raise $300 million in aninitial public offering for a new special purpose acquisitioncompany or SPAC.

Satellite imagery and data firm BlackSky to go public in latest SPAC deal

2021/02/19

BlackSky, a provider of satellite imagery and geospatial intelligence, announced Feb. 18 it has signed a deal to go public through a merger with SPAC, Osprey Technology Acquisition Corp.

SPACs raise money from investors, merge with a privately held company that then becomes publicly traded.

Tech investor Klaus Hommels launches $332 million SPAC in Europe

2021/02/18

The SPAC craze has officially arrived in Europe.

European tech investor Klaus Hommels on Wednesday launched a blank-check firm aimed at snapping up a late-stage tech company in the region.

AEye becomes latest lidar company to go public via SPAC

2021/02/18

AEye, a lidar startup that developed its technology for use in autonomous vehicles as well as to support advanced driver assistance systems in passenger cars, is going public through a merger with CF Finance Acquisition Corp. III that will value the company at $2 billion.

European bankers set sights on Amsterdam as regional Spac capital

2021/02/18

Amsterdam is emerging as Europe’s centre for blank-check companies as investors race to emulate the boom in listings that has gripped US markets. Spacs provide investors with a new and often quicker way to take businesses public.

Boeing-Backed Aerion Is in Talks for Altitude SPAC Listing

2021/02/18

Boeing-Backed Aerion is in talks to go public through a merger with Altitude Acquisition Corp. The companies are discussing a deal that would value the combined firm at up to $3 billion.

Germany’s HelloFresh founder Richter to launch U.S. SPAC

2021/02/17

Dominik Richter, the founder and chief executive of German meal kit delivery firm HelloFresh, is planning to list a special purpose acquisition company (SPAC) in New York to tap into investor interest in new offerings.

Electric vehicle maker Lucid Motors nears SPAC deal

2021/02/17

Luxury electric vehicle maker Lucid Motors is getting close to a deal to go public at a roughly $12 billion valuation after veteran dealmaker Michael Klein’s blank-check acquisition firm launched a financing effort to back the transaction.

Europe’s richest man is joining the SPAC craze

2021/02/16

Arnault’s investment holding company Financière Agache is joining forces with French asset manager Tikehau Capital and two high-profile European bankers to launch a special purpose acquisition company (SPAC) that will hunt for deals in Europe’s financial services sector.

Indonesia’s Traveloka Plans U.S. Listing Via SPAC in 2021

2021/02/16

Traveloka, Southeast Asia’s biggest online travel startup, is planning to list in the U.S. this year to raise funds using a special purpose acquistion company, known as SPAC, according to Chief Executive Offer Ferry Unardi.

Battery recycler Li-Cycle nears SPAC deal to go public

2021/02/16

Li-Cycle Corp, a recycler of lithium-ion batteries, is nearing a deal to go public through a merger with SPAC Peridot Acquisition Corp at a valuation of about $1.7 billion, according to people familiar with the matter.

Former Goldman Asia Banker Hitchner Raises $360 Million for SPAC

2021/02/15

The former head of Goldman Sachs Group Inc.’s Asia-Pacific unit outside Japan raised $360 million for a SPAC targeting health-care deals in the region, adding to the wave of former bankers joining the investing craze.

Fintech MoneyLion Gets SPAC Deal From SPY, GLD ETF Creator

2021/02/15

American digital financial platform MoneyLion announced a merger with the blank check acquisition company Fusion Acquisition Corp (NYSE: FUSE) on Friday.

MoneyLion is valued at $2.4 billion in the merger, which will give the company $500 million in gross proceeds.

Electric air-taxi startups get a lift from flurry of SPAC deals

2021/02/12

Air-taxi startup Archer Aviation has announced plans to go public through a SPAC merger with Atlas Crest Investment Corp., following a similar deal by rival Wheels Up and reports that Joby Aviation is also in talks with blank-check companies.

OppFi is the latest fintech to go public via SPAC

2021/02/12

Opportunity Financial fintech, is going public via SPAC.

The Chicago company announced Wednesday that it is merging with FG New America Acquisition Corp., a special-purpose acquisition corporation, based in Itasca, Ill.

Archer to go public through merger deal with SPAC Atlas Crest

2021/02/11

Archer announced Wednesday a merger agreement with special purpose acquisition company Atlas Crest Investment Corp.

The deal, which has an equity value of the deal is $3.8 billion, is expected to close in the second quarter of 2021, will provide about $1.1 billion in gross proceeds to the combined company.

British Entrepreneur Tobin Plans Amsterdam Tech SPAC

2021/02/11

Michael Tobin, the U.K. data center entrepreneur-turned-motivational speaker, is seeking to raise a technology-focused blank-check firm in Amsterdam as the SPAC boom makes its way across the Atlantic.

Tobin is in talks to raise 200 – 300 million euros for a SPAC, which will be called Crystal Peak.

Germany’s Rocket Internet aims for SPAC in New York, sources say

2021/02/10

German tech investment company Rocket Internet plans to list a special purpose acquisition company (SPAC) in New York to tap into investor interest in new offerings.

Rocket, led by tech entrepreneur Oliver Samwer, is preparing to list SPAC shares worth $200 million to $300 million in a deal organised by investment bank Citi.

Nautilus set to go public in reverse merger with Perceptive SPAC

2021/02/10

With the backing of Paul Allen and Jeff Bezos, among others, Nautilus Biotechnology is setting sail for Nasdaq, inking a deal with one of Perceptive’s SPACs to unlock the mysteries of the human proteome.

Gemini Therapeutics Hits the Nasdaq Following SPAC Merger

2021/02/09

Gemini Therapeutics is now trading on the Nasdaq Exchange following its merger with FS Development Corp., a special purpose acquisition company (SPAC) sponsored by Foresite Capital. The combined company will be called Gemini Therapeutics, Inc. and will trade under the ticker symbol GMTX.

Chinese EV startup Byton explores listing via SPAC deal

2021/02/09

Chinese electric vehicle (EV) maker Byton, backed by Apple assembler Foxconn, is in talks to go public through a merger with a special-purpose acquisition company (SPAC).

James Murdoch, Shankar Weigh SPAC to Acquire Asian Media Firm

2021/02/09

James Murdoch’s investment company Lupa Systems LLC, and a former senior executive at The Walt Disney Co.’s Asia unit are weighing a plan to raise funds through a special purpose acquisition company.

SoftBank files for a double scoop of SPAC

2021/02/08

SoftBank, the Japanese telecom conglomerate which has also been running the gigantic Vision Fund and its successor, doesn’t want to be left out. Yesterday, it filed back-to-back SPAC registration statements for two new SPACs.

SVF Investment Corp 2 is $200 million and SVF Investment Corp 3 is a $350 million vehicle.

Insurtech Hippo in Talks to Go Public via Merger With SPAC

2021/02/08

Hippo, an insurance technology startup, is in talks to go public through a merger with a special purpose acquisition company.

The transaction with Reinvent Technology Partners, a SPAC that counts Zynga Inc. founder Mark Pincus and LinkedIn co-founder Reid Hoffman as its lead directors, is set to value the combined entity at more than $5 billion.

Fuel cell startup Hyzon Motors appears in line for SPAC windfall

2021/02/08

Fuel cell startup Hyzon Motors Inc. appears in line for a cash windfall from a special purpose acquisition company (SPAC) as soon as this week. It would join a parade of electric vehicle makers and infrastructure companies getting their businesses funded by eager investors.

23andMe to go public at $3.5 billion with Sir Richard Branson’s SPAC

2021/02/05

The consumer DNA testing company 23andMe Inc. announced Thursday plans to go public via SPAC. The company will be listed under the VGAC ticker on the New York Stock Exchange, before changing to the ME ticker when the deal is finalized, which is expected in the second quarter of 2021.

Vista’s Solera Is in Talks to Go Public Via Apollo SPAC

2021/02/05

Vista Equity Partners-backed Solera Holdings Inc. is in talks to go public via a merger with SPAC Apollo Strategic Growth Capital.

The SPAC has begun talks with investors about raising equity to support a transaction with the financial software company.

Fintech start-up Payoneer to go public via SPAC

2021/02/04

Payoneer, a New York City-based fintech start-up that specializes in facilitating cross-border payments, is set to go public by merging with a SPAC led by Bancorp founder Betsy Cohen, the companies announced Wednesday.

The merger with Cohen’s SPAC, FTAC Olympus Acquisition Corp., values Payoneer at $3.3 billion.

Astra to go public through merger with SPAC

2021/02/03

Small launch vehicle developer Astra will go public by merging with a special-purpose acquisition company (SPAC), providing the company with nearly $500 million in cash and valuing it at more than $2 billion.

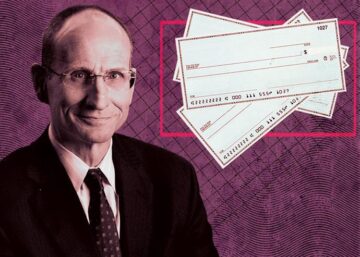

SPAC backed by former Boeing chief Muilenburg aims to raise $200 million in IPO

2021/02/03

A SPAC backed by former Boeing chief executive officer Dennis Muilenburg is aiming to raise about $200 million in an initial public offering (IPO), a regulatory filing showed on Monday.

New Vista Acquisition Corp., a special purpose acquisition company (SPAC), said it would sell 20 million units, comprising shares and warrants, priced at $10 apiece in the IPO.

Ross Acquisition II, a SPAC formed by Wilbur Ross and BroadPeak Global, files for a $300 million IPO

2021/02/03

Ross Acquisition II, a SPAC formed by Wilbur Ross and the co-founders of BroadPeak Global, filed on Tuesday with the SEC to raise up to $300 million in an initial public offering.

The Palm Beach, FL-based company plans to raise $300 million by offering 30 million units at $10.

Billionaire Tilman Fertitta floats entertainment empire in $6.7bn Spac deal

2021/02/02

Houston billionaire Tilman Fertitta is returning his business empire to the public markets after a gap of more than a decade. Holding company Fertitta Entertainment, which includes Golden Nugget casinos and Landry’s restaurants, will be floated through a reverse-merger with a special purpose acquisition company.

Gamesmaker Nexters to Go Public Via Former MegaFon CEO SPAC

2021/02/02

Nexters Global Ltd., the game developer behind Hero Wars and Throne Rush, is going public through a deal with a SPAC started by former MegaFon PJSC head Ivan Tavrin. The transaction between Limassol, Cyprus-based Nexters and Tavrin’s Kismet Acquisition One Corp. is valued at $1.9 billion, according to a statement Monday. Kismet Capital Group will invest an additional $50 million in the deal.

Israeli startup Otonomo eyeing merger with SPAC

2021/02/01

Israeli software company Otonomo Technologies Ltd., which has developed a platform for managing automotive data, is in the process of merging with special purpose acquisition company (SPAC) Software Acquisition Group, Inc. II after the latter raised $172.5 million in a Nasdaq IPO last September and announced its plans to merge with a software company.

Battery Maker Microvast Agrees to Merger With Tuscan SPAC

2021/02/01

Battery maker Microvast Inc. will go public via a merger with blank-check company Tuscan Holdings Corp.

The transaction, expected to be announced as early as Monday, will value the combined company at about $3 billion.

SPACs See Asia as Next Hunting Ground for Takeover Targets

2021/02/01

The blank-check company craze that’s taken Wall Street by storm is now spreading to Asia. A raft of funds and financiers in the region is leveraging their deal-sourcing capabilities and understanding of U.S. capital markets to jump on the bandwagon with special-purpose acquisition companies, or SPACs.

EV Maker Faraday Agrees to Property Solutions SPAC Merger

2021/01/29

Faraday Future has agreed to go public through a merger with SPAC Property Solutions Acquisition Corp., reigniting hopes that the electric-vehicle startup will be able to bring its premium car to production after a long delay.

The deal values the combined company at around $3.4 billion and is expected to generate gross proceeds of more than $1 billion.

Mobile Bank MoneyLion Is in Talks to Go Public Via Fusion SPAC

2021/01/29

MoneyLion, a mobile banking, lending and investment platform, is in talks to go public through a merger with Fusion Acquisition Corp. SPAC.

Fusion, the special purpose acquisition company, has begun discussions to raise new equity from potential investors for a transaction that’s set to value the combined entity at more than $2 billion.

Liberty Media SPAC Raised $575M With Last Week’s Public Offering

2021/01/28

Liberty Media Acquisition Corporation, the special purpose acquisition corporation of Liberty Media Corp. raised $575 million in its Jan. 22 initial offering on the Nasdaq exchange, the company announced Tuesday (Jan. 26). Liberty Media Corp. owns a majority of SiriusXM and about a third of Live Nation.

German Industry Icon Touched by SPAC Fever in $300 Million Raise

2021/01/28

A SPAC led by former Siemens AG Chief Executive Officer Klaus Kleinfeld is looking to buy or invest in a sizable firm after raising $300 million in a stock-market listing.

“We’re screening Europe, especially the German-speaking region, and the U.S. for targets for either a full takeover or a stake,” Kleinfeld said in an interview.

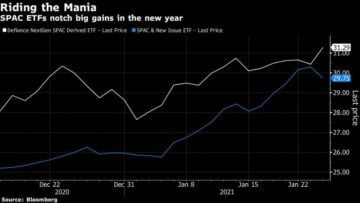

SPAC Boom Heats Up as Latest Blank-Check ETF Hits the Market

2021/01/27

There’s a new exchange-traded fund tracking the hot trend of blank-check companies.

The actively managed Morgan Creek – Exos SPAC Originated ETF (SPXZ) started trading Tuesday and charges a 1% expense ratio, according to a statement from Morgan Creek Capital Management and New York-based EXOS Financial.

MGM Resorts-Backed Playstudios Is Discussing SPAC Deal

2021/01/27

Game developer Playstudios Inc. is in talks with a special purpose acquisition company, joining a stampede of businesses that are leaning on SPACs to go public. Playstudios is discussing a deal with SPAC Acies Acquisition Corp.

Chamath Palihapitiya Invests in Two Deals in One Day During SPAC Boom

2021/01/27

Serial SPAC dealmaker Chamath Palihapitiya has doubled down on SPACs and has now participated in at least half a dozen deals that his own SPAC vehicles aren’t even involved in.

Apollo SPAC Agrees to Take Solar Lender Sunlight Public

2021/01/26

Sunlight Financial LLC, which provides loans to homeowners for rooftop solar panels, has agreed to go public through a merger with a special purpose acquisition company backed by Apollo Global Management Inc.

The deal with SPAC Spartan Acquisition Corp. II gives Sunlight an implied equity value of about $1.3 billion.

Taboola Is Joining The SPAC Craze With Plans To Go Public

2021/01/26

Content recommendation engine Taboola is planning to go public later this year, making it the latest company to take advantage of a white-hot trend by merging with a special-purpose acquisition company (SPAC).

EVgo To Publicly List Through Business Combination With A SPAC

2021/01/25

EVgo, one of the largest fast charging networks in the U.S., announced a definitive agreement for a business combination with Climate Change Crisis Real Impact I Acquisition Corporation, a special purpose acquisition company already publicly traded on NYSE (CLII).

Foley-backed SPAC nears US$7.3 billion deal with Blackstone’s Alight

2021/01/25

A SPAC backed by veteran investor Bill Foley is nearing an agreement to take Alight Solutions, the US benefits services provider owned by buyout firm Blackstone, public at a valuation of US$7.3 billion including debt.

Thoma Bravo’s $900 Million SPAC

2021/01/25

Thoma Bravo launched its $900 million special purpose acquisition company (SPAC) that will target an acquisition in the software and technology sectors. In its SEC filing, Thoma Bravo said it plans to raise $900 million by offering 90 million units at $10.

Hims & Hers closes its SPAC merger, lists on NYSE

2021/01/22

Consumer telehealth and wellness brand Hims & Hers wrapped up its merger with special purpose acquisition company (SPAC) Oaktree Acquisition Tuesday, and today began trading on the New York Stock Exchange.

Real estate mogul Barry Sternlicht on what the SPAC market might look like in 2021

2021/01/22

Real estate mogul Barry Sternlicht announced his third special purpose acquisition company: Jaws Mustang Acquisition. This SPAC joins the ranks of well over 200 SPACs that have gone to market in the last year. Sternlicht joined “Squawk Box” on Thursday to discuss.

ScION Tech Growth II files for a $300 million IPO

2021/01/21

ScION Tech Growth II, the second UK SPAC formed by ION Investment Group targeting technology, filed on Wednesday with the SEC to raise up to $300 million in an initial public offering.

The London, UK-based company plans to raise $300 million by offering 30 million units at $10.

Payments Startup Payoneer in Merger Talks With SPAC

2021/01/21

Payoneer Inc., an online payments specialist, is in talks to go public through a merger with FTAC Olympus Acquisition Corp., SPAC.

The special purpose acquisition company has begun talks to raise new equity to support a transaction that’s slated to value the combined entity at more than $2.5 billion.

Former Barclays Chair Makram Azar on SPAC market boom

2021/01/20

Huge interest for the IPO of a SPAC that focuses on acquiring companies in EUROPE, mainly in the area of TMT. Golden Falcon Acquisition Corporation (listed at NYSE, GFX.U) raised $345 mln, up from initially planned $250 mln.

FoxWayne Enterprises Acquisition Corp. (FOXWU) Prices $50M IPO

2021/01/20

FoxWayne Enterprises Acquisition Corp. announced the pricing of its $50 million IPO this evening and its units are expected to begin trading on the Nasdaq under the symbol “FOXWU” Wednesday, January 20.

The new company aims to combine with a biotechnology or telemedicine business in North America that will be resilient to economic cycles.

Intel Chairman Planning Up to $1 Billion Health-Tech SPAC IPO

2021/01/19

Intel Corp. Chairman Omar Ishrak is planning to raise funds for a SPAC firm targeting deals in the health technology sector.

Ishrak is targeting to raise about $750 million to $1 billion for the special purpose acquisition company, or SPAC.

Genius Sports confident of meeting $145m 2020 revenue target ahead of SPAC IPO

2021/01/19

Genius Sports Group expects to generate full-year revenue for 2020 of $145m after filing the necessary documents to complete its business combination with SPAC dMY Technology II. Within a new SEC filing, the data provider reported a 32% year-on-year revenue increase for the nine months to September 30, 2020.

SoftBank prepares to file for SPAC IPO worth up to $600 million

2021/01/18

SoftBank’s Vision Fund is preparing to raise between $500 million and $600 million via an initial public offering of its first special purpose acquisition company (SPAC), U.S. news portal Axios reported on Sunday.

LiveVox to Go Public Via SPAC Deal with Crescent Acquisition

2021/01/15

Customer-service software provider LiveVox is going public through a merger with blank-check firm Crescent Acquisition Corp., the latest technology company to take the alternative route to the public markets.

Tilman Fertitta Is in Talks to List Casino, Dining Assets Via SPAC

2021/01/15

Texas billionaire and Houston Rockets owner Tilman Fertitta is in talks to take his casino and restaurant empire public through a merger with SPAC firm Fast Acquisition Corp.

The special purpose acquisition company is in talks to raise more than $1 billion in new equity to support a transaction.

Talkspace to go public via SPAC in $1.4B deal

2021/01/15

Talkspace on Wednesday became the latest digital health company to go public, announcing it intends to merge with a special purchase acquisition company in a deal valuing the behavioral health startup at $1.4 billion.

The electric vehicle SPAC boom is likely to continue as over $2.5 trillion is needed to make a full transition to EVs

2021/01/14

The number of electric vehicle SPACs may rise in the years to come as the world pivots to full EV adoption and looks for ways to raise money to fund the transition, according to Bank of America.

Proterra Set To Take Heavy-Duty Electric Vehicle Public via SPAC

2021/01/13

Proterra, builder of electric buses, heavy-duty vehicle drivetrains, batteries and charging systems, plans to go public on the Nasdaq exchange via a merger with a special-purpose acquisition company (SPAC), the latest in a string of EV companies seeking access to public market financing to meet growing demand.

Navigation Capital Partners SPAC Operations Significantly Expands SPAC Portfolio

2021/01/12

Navigation Capital Partners (Navigation), an Atlanta-based private equity firm, today announced significant expansion of its SPAC Operations portfolio by funding three special purpose acquisition companies (SPACs). Navigation launched its SPAC Operations Group in 2019.

Former Credit Suisse boss Tidjane Thiam lining up $250m Spac with JPMorgan

2021/01/12

Former Credit Suisse chief executive, Tidjane Thiam, is joining the rush of high-profile financial services executives launching so-called blank cheque companies and is planning a $250m special purpose acquisition vehicle to invest in financial services organisations.

Talkspace Near a Deal to Go Public Via Doug Braunstein’s SPAC

2021/01/12

Talkspace, an online therapy app promoted by celebrities including swimmer Michael Phelps and singer Demi Lovato, is nearing a deal to go public through a merger with Hudson Executive Investment Corp. SPAC.

The special purpose acquisition company is discussing raising more than $200 million in new equity to support a merger with New York-based Talkspace.

Lucid Motors Is in Talks to List Via Michael Klein SPAC

2021/01/12

Electric vehicle maker Lucid Motors Inc. is in talks to go public through a merger with one of Michael Klein’s special purpose acquisition companies. A transaction could be valued at up to $15 billion.

Lucid, which is backed by Saudi Arabia’s sovereign wealth fund, is working with financial advisers, the people added. The talks are ongoing but could still fall apart.

Perella Weinberg Partners Finally Goes Public Through Betsy Cohen’s SPAC Fintech IV

2021/01/11

Perella Weinberg Partners agrees to be acquired by Betsy Cohen’s SPAC, Fintech IV. Two years ago, PWP was working on going public through an IPO.

Perella Weinberg, a boutique investment bank, will become a publicly traded company, and expects to list its deal advisory business on NASDAQ under the PWP symbol.

EV Startup Faraday Said in SPAC Merger Talks to Go Public

2021/01/11

Faraday & Future Inc., an electric-vehicle startup, is in talks to go public through a merger with Property Solutions Acquisition Corp., a SPAC.

The special purpose acquisition company is seeking to raise more than $400 million in equity to support the transaction, which is slated to value the combined entity at around $3 billion.

Media SPAC Virtuoso Acquisition files for a $180 million IPO

2020/12/30

Virtuoso Acquisition, a SPAC formed by Connoisseur Media targeting a media business, filed on Tuesday with the SEC to raise up to $180 million in an initial public offering.

The Westport, CT-based company plans to raise $180 million by offering 18 million units at $10.

Perella Weinberg Inks Deal With Betsy Cohen’s SPAC

2020/12/30

Boutique investment bank Perella Weinberg Partners has agreed to go public by combining with a SPAC sponsored by finance entrepreneur Betsy Cohen, according to a person familiar with the matter.

FinTech Acquisition Corporation IV, Cohen’s $230 million SPAC, will acquire the firm through a transaction in which investors are committing $125 million of private financing.

2020 Has Been the Year of SPAC IPOs: Here Are the Prominent 4

2020/12/29

In 2020, SPACs make up most of the growth in the U.S. IPO market compared with the year-ago level.So far this year, SPACs have raised $79.87 billion in gross proceeds from 237 counts, surpassing the record $13.6 billion raised in 2019 (raised from 59 IPOs). The average IPO size was $337 million.

Bravo! Thoma Bravo’s software SPAC Thoma Bravo Advantage files for a $900 million IPO

2020/12/29

Thoma Bravo Advantage, a SPAC formed by Thoma Bravo targeting a software business, filed on Monday with the SEC to raise up to $900 million in an initial public offering.

The Chicago, IL-based company plans to raise $900 million by offering 90 million units at $10.

Multi-strategy private equity firm’s SPAC TZP Strategies Acquisition files for a $250 million IPO

2020/12/29

TZP Strategies Acquisition, a blank check company formed by TZP Group targeting the tech, business, and consumer sectors, filed on Monday with the SEC to raise up to $250 million in an initial public offering.

REE Automotive in negotiations for a $3-4 billion Nasdaq SPAC merger

2020/12/28

The list of Israeli companies mulling entering Nasdaq via a SPAC continues to grow, with REE Automotive, which develops modular platforms for electric vehicles, in negotiations to go public at a valuation of between $3-4 billion.

Clearlake-backed Janus International to merge with SPAC

2020/12/23

Metal windows and doors maker Janus International Group LLC, backed by private equity firm Clearlake Capital, said on Tuesday it is merging with a SPAC Juniper Industrial Holdings Inc.

The combined entity will be valued at $1.9 billion including debt, and will list on the NYSE after close of the deal.

Healthcare Services Acquisition Corp (HCARU) Prices Upsized $288M IPO

2020/12/23

Healthcare Services Acquisition Corporation announced the pricing of its upsized $288 million IPO this evening and its units are expected to begin trading on the Nasdaq under the symbol HCARU” Wednesday, December 23.

The new company aims to combine with a technology-enabled healthcare services target with significant white space in home or adjacent markets.

SoftBank launches blank-check company to join SPAC craze

2020/12/23

SoftBank Group filed to launch a special purpose acquisition company on Monday, saying it planned to raise $525 million for an investment in a technology company.

The Japanese investment giant is the latest big name to jump on the wave of so-called SPAC.

Lilium reportedly seeking public investment via SPAC in high-stakes test for electric air taxi-makers

2020/12/22

German electric air taxi developer Lilium is reportedly pursuing additional funding from public markets through a reverse merger with a special purpose acquisition company, or SPAC, numerous sources with knowledge of ongoing discussions tell eVTOL.com.

Omega Funds’ biotech SPAC Omega Alpha SPAC files for a $100 million IPO

2020/12/22

Omega Alpha SPAC, a blank check company formed by Omega Funds targeting the biotech sector, filed on Monday with the SEC to raise up to $100 million in an initial public offering.

The Boston, MA-based company plans to raise $100 million by offering 10 million shares at $10.

Opendoor rises 6% in Nasdaq debut after merging with Palo Alto SPAC

2020/12/22

OpenDoor Labs Inc. shares rose nearly 6% in their debut on the public markets Monday after it merged with Social Capital Hedosophia II, a Palo Alto-based special purpose acquisition company (SPAC).

Blackstone in talks to merge Alight with Bill Foley’s SPAC

2020/12/21

BLACKSTONE Group Inc is in talks to merge Alight Solutions LLC with Foley Trasimene Acquisition Corp, a blank-cheque special acquisition firm backed by investor Bill Foley, Reuters reported.

The merger would lead to Alight, a benefits administrator business, becoming a publicly-listed firm at a valuation of more than US$8 billion.

SoftBank to File Monday for SPAC to Raise Over $500 Million

2020/12/21

SoftBank Group Corp. plans to file Monday to raise at least $500 million through a blank-check company, a person familiar with the situation said, tapping investor enthusiasm for the controversial listing vehicles.

The SPAC, will be overseen by SoftBank Investment Advisers, which also runs the Vision Fund. It will be used to buy a company SoftBank hasn’t previously invested in.

Skillz, Corner Growth Acquisition join growing number of Bay Area SPAC companies

2020/12/18

Skillz Inc., the mobile esports company, started trading on the New York Stock Exchange under the symbol SKLZ following its merger with Flying Eagle Acquisition, a Los Angeles-based entity comprised of the same people who took the fantasy sports company DraftKings (Nasdaq: DKNG) public through a SPAC.

Healthcare SPAC KL Acquisition files for a $250 million IPO

2020/12/18

KL Acquisition, a SPAC formed by Kennedy Lewis targeting the healthcare industry, filed on Thursday with the SEC to raise up to $250 million in an initial public offering.

At the proposed deal size, KL Acquisition would command a market value of $313 million.

Satellite-to-smartphone broadband company AST & Science to go public through a SPAC

2020/12/17

Special purpose acquisition company New Providence will take next-generation satellite broadband specialist AST & Science public through a SPAC deal that gives the space company an equity value of $1.8 billion, the firm announced Wednesday.

AST will list on the Nasdaq under the ticker symbol ASTS when the deal closes.

SoftBank Nears Another Win as Tokopedia Weighs Sale to Billionaires’ SPAC

2020/12/17

Fresh off a huge win with the DoorDash initial public offering

DoorDash IPO Spurs Uber, Lyft and Grubhub. SoftBank Is the Biggest Winner.

The startling public-market debut for DoorDash is having ripples among other stocks in the food-delivery and gig-economy companies.

Indie Semiconductor to go public through SPAC that values company at $1.4 billion

2020/12/16

Indie Semiconductor announced Tuesday an agreement to go public through a merger with special purpose acquisition company (SPAC) Thunder Bridge Acquisition II Ltd., in a deal that values the combined company at about $1.4 billion.

Blade Takes Off for the Stock Markets

2020/12/16

Blade Urban Air Mobility, the New York-based helicopter taxi service, has struck a deal to go public via a sale to a SPAC backed by KSL Capital that values the company at about $825 million.

The deal includes $400 million in proceeds, which includes a $125 million infusion along with the cash in the SPAC. Pending the deal’s closure, it will trade on the Nasdaq under the ticker “BLDE.”

Thiel-Backed Bridgetown SPAC Weighs Up to $10 Billion Tokopedia Deal

2020/12/16

Bridgetown Holdings Ltd., the blank-check company backed by billionaires Richard Li and Peter Thiel, is considering a potential merger with Indonesia’s e-commerce giant PT Tokopedia.

The SPAC is exploring the structure and feasibility of a deal with Tokopedia, one of the most valuable startups in the southeast Asian nation.

Goldman says the SPAC boom will continue and found a way to spot ones that may outperform

2020/12/15

The historic SPAC boom in 2020 is more than just a fad, Goldman Sachs said. For investors wanting to cash in on the red-hot market, the firm said it identified a key element in winning blank-check deals.

SPACs are an investment vehicle that goes public without having a real business. The goal is to raise funds to finance a merger or acquisition typically within two years.

TMT and entertainment SPAC Marquee Raine Acquisition prices $325 million IPO at $10

2020/12/15

Marquee Raine Acquisition, a blank check company formed by The Raine Group and the Chicago Cubs’ owner targeting the TMT industry, raised $325 million by offering 32.5 million units at $10.

Each unit consists of one share of common stock and one-fourth of a warrant, exercisable at $11.50; the company originally filed with one-third warrants, but lowered to quarter warrants likely in a sign of demand.

Without an IPO, Israeli Startup Innoviz to List at a $1.4b Valuation

2020/12/14

The Israel startup Innoviz Technologies, which has developed LiDAR sensors that enable self-driving cars to see their surroundings, said on Friday it would list on the Nasdaq Stock Market by merging with a special purpose acquisition company, or SPAC.

Spotify Backer Lakestar Said to Plan Rare German SPAC IPO

2020/12/11

Lakestar, an early investor in Spotify Technology SA, is looking to raise as much as 400 million euros ($484 million) for a rare Europe-listed blank-check company, people familiar with the matter said.

SPACs have been the go-to method for wealthy sponsors seeking money for takeovers this year, with record global proceeds of more than $75 billion raised for these vehicles.

Lightning EMotors to Go Public in Reverse Merger With SPAC

2020/12/11

Lightning eMotors, a company that electrifies commercial-vehicle fleets, has agreed to go public through a merger with GigCapital3 Inc., a SPAC.

The deal is expected to generate gross proceeds of $125 million and gives Lightning eMotors a pro-forma equity valuation of around $823 million.

Xavier Niel’s organic food Spac rallies in Paris debut

2020/12/10

A SPAC founded by telecoms billionaire Xavier Niel and two other prominent French businessmen jumped on its first day of trading after raising €300m in the largest public offering on the Paris market this year.

2MX Organic aims to acquire companies involved in the fast-growing sectors of organic food and sustainable consumer goods.

Carney Technology Acquisition Corp. II (CTAQU) Prices $350M IPO

2020/12/10

Carney Technology Acquisition Corp. II announced the pricing of its $350 million IPO this evening and its units are expected to begin trading on the Nasdaq under the symbol “CTAQU” tomorrow, Thursday, December 10.

The new company aims to combine with a technology business that is currently on a path valuing high growth over profitability.

HydraFacial and Vesper Healthcare Announce $1.1B Merger Deal

2020/12/10

HydraFacial and Vesper Healthcare Acquisition today announced that they have entered into a definitive merger agreement.

The transaction has a pro forma enterprise value of $1.1 billion, the companies said.

Motiv Power looks to scale EV chassis business via SPAC merger

2020/12/09

Electric vehicle chassis maker Motiv Power Systems is talking to special purpose acquisition companies about tying the knot. With proven technology and growing orders, the early stage growth company seems an ideal candidate for a SPAC dowry.

A wave of passion for SPACs is washing from the US to other shores

2020/12/09

As more fast-growing companies eschew traditional initial public offerings (IPOs) because of pandemic-induced market volatility, SPAC IPOs are quickly becoming their alternative of choice and are even drawing attention outside the US.

Gross 2020 SPAC proceeds stood at $62.7 billion as of November 8, compared with $13.6 billion in all of 2019. Deal counts were 170, versus 59 in 2019 and 46 in 2018, according to SPACInsider. In the third quarter, SPAC IPO deal counts and aggregate values were almost equal to those for traditional IPOs.

Paysafe to go public via merger with Bill Foley-backed SPAC

2020/12/08

A blank-check acquisition firm backed by veteran investor Bill Foley said on Monday it had agreed to merge with payments platform Paysafe Group Holdings Ltd, valuing the company at around $9 billion, including debt.

Paysafe’s merger with Foley Trasimene Acquisition Corp II will result in the London-based company listing on the New York Stock Exchange under the symbol “PSFE”.

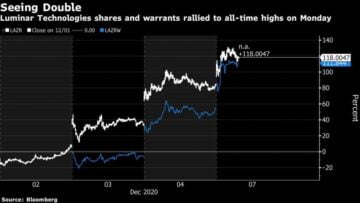

Luminar Technologies More Than Doubles Post SPAC Merger

2020/12/08

Peter Thiel-backed Luminar Technologies Inc. briefly touched an all-time high within days of emerging as a standalone company as investor excitement over developers of laser-sensors that enable autonomous driving (lidar) ramped up.

Shares of Luminar more than doubled since it completed its reverse merger with special purpose acquisition company Gores Metropoulos last week, trading above $38 Monday afternoon.

7GC & Co. Holdings, a tech SPAC, files for a $175 million IPO

2020/12/08

7GC & Co. Holdings, a SPAC formed by 7GC and Hennessy Capital targeting a tech business, filed on Monday with the SEC to raise up to $175 million in an initial public offering.

The San Francisco, CA-based company plans to raise $175 million by offering 17.5 million units at $10. At the proposed deal size, 7GC & Co. will command a market value of $219 million.

The SPAC Pop Is Now A Thing: More Unicorns Getting On Board

2020/12/07

Until recently, taking a unicorn public pretty much always involved a traditional initial public offering or direct listing. But in recent quarters, a once-obscure option—a merger with a special purpose acquisition company, or SPAC—has become an increasingly mainstream alternative.

EV maker Lion Electric to go public through SPAC deal

2020/12/07

Electric-vehicle maker Lion Electric Co said on Monday it would go public through a merger with blank-check company Northern Genesis Acquisition Corp.

Lion Electric expects to receive about $500 million of net cash proceeds from the deal, it said, adding the combined company was expected to be listed on the New York Stock Exchange under the symbol “LEV”.

Bill Foley-backed Spac nears $9bn deal to buy Paysafe

2020/12/07

Blackstone and CVC have agreed to list Paysafe at a $9bn valuation via a merger with a blank-check company launched by billionaire Bill Foley. The deal triples the private equity firms’ investment three years after buying out the UK fintech group, said people briefed on the deal.

Jeff Hammes and Adam Gerchen’s Legal Tech SPAC Has Two Dozen Targets in Sight

2020/12/04

Litigation finance veteran Adam Gerchen says the legal tech-focused special purpose acquisition company he launched with former Kirkland & Ellis chairman Jeffrey Hammes, which started trading on the New York Stock Exchange in mid-November, has identified two dozen “high-prospect” acquisition targets.

SPAC vs Traditional IPO: Investors See Benefits of Blank-check Companies

2020/12/04

While 2020 will be remembered for a lot of things, in the investment world it may be known as the year of the special purpose acquisition company, also known as a SPAC.

The market has witnessed in excess of $70 billion in gross proceeds from more than 200 SPACs so far this year, according to SPAC Insider, and investors expect a robust pipeline in 2021.

Israeli Lidar Startup Innoviz in Talks to Merge With SPAC

2020/12/04

Innoviz Technologies Ltd., an Israeli startup focused on lidar, laser sensors used in autonomous vehicles, is in talks to go public through a merger with Collective Growth Corp.

Collective Growth is seeking to raise $100 million to $350 million in new equity to support a transaction that’s set to value the combined entity at $1 billion or more.

KC-based SPAC helps electric vehicle-maker go public

2020/12/03

Quebec-based Lion Electric Co. will use $500 million from a special-purpose acquisition corporation (SPAC) based in Kansas City to fund construction of electric vehicle production plants in the U.S.

Ex-Barclays Banker Azar Seeks $250 Million to Join SPAC Rush

2020/12/03

Makram Azar, formerly a senior Barclays Plc banker, is setting up a SPAC company with dealmaker Scott Freidheim to pursue deals in the telecommunication, media and technology sectors.

Golden Falcon Acquisition Corp. filed Tuesday to raise $250 million through an initial public offering. The SPAC, will target companies headquartered in Europe, Israel, the Middle East or North America.

Dyal and Owl Rock plan merger in one of largest Spac deals

2020/12/03

Dyal Capital is in talks to merge with Owl Rock Capital and go public via a SPAC vehicle in a complex deal that will value the two asset managers at a combined $13bn.

Altimar Acquisition Corporation, the SPAC, set up by HPS Investment Partners, said in a regulatory filing it was in exclusive talks with the companies but there was no guarantee a deal would be agreed.

ION-backed SPAC aims to raise $500 million in U.S. IPO

2020/12/02

(Reuters) – Financial software group ION is sponsoring a $500 million listing of a special purpose acquisition vehicle (SPAC) to invest in financial technology and services, filings with the U.S. securities regulator showed.

Freight Startup Transfix in Talks to Go Public Via SPAC

2020/12/02

Transfix, a logistics startup that operates a freight marketplace, is in talks to go public through a merger with a blank-check firm, Tuscan Holdings Corp. II, according to a person with knowledge of the matter.

Why Lordstown Looks to Be An Early SPAC Winner

2020/12/02

One of the newest names on the Nasdaq composite is Lordstown Motors (NASDAQ:RIDE). The electric truck manufacturer went public as RIDE stock in late October after a blank-check merger with DiamondPeak Holdings.

Lordstown stock is up nearly 40% since the company began trading on Oct. 26. There are reasons to believe that Lordstown maintains great potential for growth-minded investors.

EV bus and truck maker The Lion Electric to take SPAC route to public markets

2020/12/01

Canadian electric truck and bus manufacturer The Lion Electric Company said Monday it plans to become a publicly traded company via a merger with special purpose acquisition company Northern Genesis Acquisition Corp.

The combined company, which will be listed on the New York Stock Exchange, will have a valuation of $1.9 billion. The companies raised $200 million in private investment in public equity, or PIPE, and hold about $320 million in cash proceeds.

Key Microsoft SaaS Partner AvePoint Plans $2 Billion IPO via SPAC

2020/11/26

Microsoft SaaS partner AvePoint is planning an IPO by selling itself to Apex Technology Acquisition Corp. Apex, a special-purpose acquisition company (SPAC), will acquire AvePoint in a deal that values the company at nearly $2 billion.

Veteran technology investors Jeff Epstein, operating partner at Bessemer Venture Partners, and Brad Koenig, co-CEO at Apex, formed the SPAC last year.

Telehealth Provider Cloudbreak to Be Acquired by SPAC

2020/11/26

El Segundo telehealth provider Cloudbreak Health has agreed to be acquired by a Palo Alto special purpose acquisition company, or SPAC, and will join a family of digital health companies run by Delray Beach, Fla.-based UpHealth Holdings Inc. early next year, the companies announced Nov. 23.

Once the transaction is completed, Cloudbreak will join six other companies that are part of UpHealth’s digital health empire.

Roth Capital’s second SPAC Roth CH Acquisition II files for a $100 million IPO

2020/11/26

Roth CH Acquisition II, the second SPAC formed by executives at Roth Capital and Craig-Hallum, filed on Tuesday with the SEC to raise up to $100 million in an initial public offering.

The Newport Beach, CA-based company plans to raise $100 million by offering 10 million units $10.

French Billionaire Niel Is Said to Plan SPAC for Consumer Deals

2020/11/25

French telecommunications billionaire Xavier Niel is planning to raise capital through a blank-check firm, people with knowledge of the matter said.

Niel and his partners are setting up a new vehicle to target acquisitions in the European consumer sector.

AvePoint to go public via SPAC valued at $2B

2020/11/24

AvePoint, a company that gives enterprises using Microsoft Office 365, SharePoint and Teams a control layer on top of these tools, announced today that it would be going public via a SPAC merger with Apex Technology Acquisition Corporation in a deal that values AvePoint at around $2 billion.

Wealthy Europeans Join SPAC Club in Record Year for Listings

2020/11/24

Listing a SPAC has been the go-to method for wealthy Americans to raise money for takeovers this year. SPACs have raised more than $60 billion to pursue targets in 2020, a record, according to data compiled by Bloomberg. The U.S. accounts for almost all of that figure.

Now, Europeans are joining the hunt. Investindustrial Acquisition Corp., a private equity firm backed by UBS Group AG’s former Chief Executive Officer Sergio Ermotti, announced last week that it was raising $350 million by listing a SPAC on the New York Stock Exchange.

Liberty Media Corporation Launches SPAC: What Investors Should Know

2020/11/23

Liberty Media Corporation, one of the largest media companies in the U.S., is entering the SPAC market with a newly announced IPO.

The sponsor of the SPAC offering is Liberty Media Corp. The company is the owner of The Liberty Braves Group, Formula One Group and The Liberty SiriusXM Global.

Palo Alto SPAC GigCapital3 may join run of ‘blank check’ auto tech mergers

2020/11/23

The Palo Alto-based special purpose acquisition company (SPAC) is in advanced talks with Lightning eMotors, a Colorado-based company that focuses on commercial fleet electrification and cutting out fuel consumption, according to Bloomberg.

Biotech SPAC Frazier Lifesciences Acquisition files for a $100 million IPO

2020/11/23

Frazier Lifesciences Acquisition, a blank check company formed by Frazier Healthcare Partners targeting the biotech industry, filed on Friday with the SEC to raise up to $100 million in an initial public offering.

The Seattle, WA-based company plans to raise $100 million by offering 10 million units at a price of $10. At the proposed deal size, the SPAC would command a market value of $129 million.

Boutique SPAC merges Wall Street and Easy Street

2020/11/23

Frazier Lifesciences Acquisition, a SPAC formed by Frazier Healthcare Partners targeting the biotech industry, filed on Friday with the SEC to raise up to $100 million in an initial public offering.

The Seattle, WA-based company plans to raise $100 million by offering 10 million units at a price of $10. At the proposed deal size, the SPAC would command a market value of $129 million.

Tishman Speyer creates $300M SPAC for Proptech investments

2020/11/20

Tishman Speyer, one of the largest commercial real estate landlords in the United States with a 78 million square feet portfolio, recently created a $300 million special purpose acquisition company (SPAC) to invest in property technology (Proptech).

A Tesla rival is going public at a $5.4 billion valuation via a SPAC

2020/11/20

British electric-vehicle startup Arrival will go public by combining with a US “SPAC” set up by Peter Cuneo, the former CEO of Marvel Comics and personal care firm Remington Products.

The deal would value the combined company at $5.4 billion and is expected to raise a total of $660 million, Arrival said in a statement.

Electric Last Mile Said to Be In Merger Talks With Forum SPAC

2020/11/20

Electric Last Mile Solutions, an electric vehicle startup, is in talks to go public through a merger with Forum Merger III Corp., according to people with knowledge of the matter.

Forum in August raised $250 million in an initial public offering. While it has the flexibility to pursue a target in any industry, the SPAC said at the time it intended to focus on companies based in the U.S. worth $500 million to $2 billion.

Aviation SPAC Zanite Acquisition prices $200 million IPO at $10

2020/11/18

Zanite Acquisition, a SPAC formed by Resilience Capital and Directional Aviation, raised $200 million by offering 20 million units at $10. Each unit consists of one share of common stock and one-half of a warrant, exercisable at $11.50.

BlackRock-Backed Arrival in Talks to Go Public Via SPAC

2020/11/18

Arrival Ltd., a maker of electric vans and buses backed by investors including BlackRock Inc., is in talks to combine with CIIG Merger Corp., a blank-check firm, according to people with knowledge of the matter.

CIIG, a special purpose acquisition company, is in discussions with investors about raising $400 million to $500 million in new equity to support a transaction for the startup.

Plastics Recycler PureCycle Technologies Going Public Via SPAC

2020/11/17

PureCycle Technologies, a plastics recycling company with technology from Procter & Gamble Company, is going public via a SPAC. PureCycle Technologies will go public via a merger with Roth CH Acquisition I.

The merger values PureCycle Technologies with an enterprise value of $1.2 billion.

Victory Park Capital’s SPAC L&F Acquisition lowers deal size by 25% ahead of $150 million IPO

2020/11/17

L&F Acquisition, a second blank check company formed by Victory Park Capital targeting governance, risk, compliance and legal tech, lowered the proposed deal size for its upcoming IPO on Monday.

The Chicago, IL-based company now plans to raise $150 million by offering 15 million units at a price of $10. The company had previously filed to offer 20 million units at the same price.

Growth-focused SPAC Aequi Acquisition lowers proposed deal size by 33% ahead of $200 million IPO

2020/11/17

Aequi Acquisition, a blank check company targeting data-centric, growth-oriented companies with established business models, lowered the proposed deal size for its upcoming IPO on Monday.

The Greenwich, CT-based company now plans to raise $200 million by offering 20 million units at $10.

‘The great 2020 money grab’: Muddy Waters unloads on Spacs

2020/11/13

Muddy Waters, the US short seller run by Carson Block, has launched a scathing attack on 2020’s hottest investment phenomenon, the special purpose acquisition company, and revealed it is betting against a company brought to market by former Citigroup dealmaker Michael Klein.

Sustainable food SPAC Natural Order Acquisition prices $200 million IPO at $10

2020/11/12

Natural Order Acquisition, a blank check company focusing on technologies and products related to sustainable plant-based food and beverages, raised $200 million by offering 20 million units at $10. Each unit consists of one share of common stock and a whole warrant to purchase one-half of a common share, exercisable at $11.50. The company originally planned to offer 25 million units before decreasing the deal size last week.

The company is led by Chairman Sebastiano Castiglioni, a Partner at Blue Horizon Group, founder and Director of private investment fund Dismatrix, and an active investor in the global plant-based food and beverage sector

Microvast in Talks to Go Public Via Tuscan SPAC Merger

2020/11/12

Microvast, a maker of electric batteries, is in advanced talks to go public through a merger with the blank-check company Tuscan Holdings Corp., according to people with knowledge of the matter.

Tuscan, a special purpose acquisition company, or SPAC, is seeking to raise about $200 million in new equity to fund the transaction. The transaction would value the combined entity at about $2 billion or higher, the people said.

Its SPAC Merger Behind It, Paya Reports Growth ‘Momentum’ From ACH

2020/11/11

Paya Holdings Inc. is known for its base in integrated payments and for its processing concentration in card-not-present transactions. But what also became clear early Monday is its growing strength in bringing capability for automated clearing house payments to its roster of clients.

CBRE latest real estate firm to hop on SPAC bandwagon

2020/11/11

CBRE, the world’s largest real estate services firm, has formed a SPAC, called CBRE Acquisition Holdings. The new special-purpose acquisition company is seeking to “identify and acquire a privately held company with significant growth potential” for a merger or acquisition, according to a regulatory filing.

FOA CEO on why the company is going public

2020/11/11

FOA CEO, Patricia Cook, said her company’s SPAC, and the spate of similar public offerings, represents a significant achievement for independent mortgage banks after a year spent growing their collective market share.

She said FOA decided to make its SPAC, in partnership with Replay Acquisition Corp, for long-term strategic reasons.

RedBall Acquisition: An Interesting Sports SPAC Opportunity

2020/11/10

RedBall has an interesting potential “heads you win, tails you don’t lose much” setup for the patient investor.

At the time of writing, the RedBall Acquisition Corp. trades at $10.06. If no deal emerges, or a deal fails, you will likely receive $10 back. Thus you are paying $0.06, plus the opportunity cost of parking your money elsewhere, for an option on RedBall finding an attractive merger partner at below fair value.

N*GEN Partners’ healthy living SPAC Better World Acquisition lowers proposed deal size by 20% ahead of $100 million IPO

2020/11/10

Better World Acquisition, a SPAC formed by N*GEN Partners targeting a healthy living business with a strong ESG profile, lowered the proposed deal size for its upcoming IPO on Monday. In its latest filing, the company also added I-Bankers Securities as an underwriter.

The New York, NY-based company now plans to raise $100 million by offering 10 million units at $10. The company had previously filed to offer 12.5 million units at the same price. Each unit now consists of one share of common stock and one warrant, exercisable at $11.50. Each unit previously contained one-half of a warrant. At the revised deal size, Better World Acquisition will raise -20% less in proceeds than previously anticipated.

TikTok rival Triller explores deal to go public, say sources

2020/11/09

Triller Inc, a budding competitor to popular short-video app TikTok, is in discussions with SPAC acquisition companies about a merger which would take the U.S. social media company public.

The deal would come as Triller seeks to capitalize on TikTok’s woes. U.S. President Donald Trump’s administration has ordered TikTok’s Chinese parent ByteDance to divest the app, citing concerns that the data of U.S. citizens could be accessible to China’s Communist Party government.

New York investment fund Blackstone’s Paysafe in merger talks with Foley’s SPAC

2020/11/09

Paysafe Group Inc., the London-based online payment firm backed by the world’s largest alternative asset investment fund Blackstone having had $571 billion worth of assets under its management to date alongside CVC Capital Partners, had been in an advanced stage merger talk with a blank-check SPAC founded by an old-school investor Bill Foley, a Bloomberg news report published late on Friday had unveiled.

More Auto Companies Looking to Get SPAC’ed

2020/11/06

The auto industry is partnering with investment banks to reap the big money benefits of a new acronym: SPAC. The big question is: What are they?

Fisker, Nikola, Canoo and Lordstown have all gone through the process which is, essentially, a reverse merger. Each of the four have or will end up with valuations exceeding $1 billion after the deal is done, securing hundreds of millions of dollars in additional development cash in the process.

Growth-focused SPAC Live Oak Acquisition II files for a $200 million IPO

2020/11/06

Live Oak Acquisition II, the second SPAC formed by Live Oak Merchant Partners targeting a high-growth business, filed on Wednesday with the SEC to raise up to $200 million in an initial public offering.

The Memphis, TN-based company plans to raise $200 million by offering 20 million units at $10. Each unit consists of one share of common stock and one-third of one warrant, exercisable at $11.50. Atalaya Capital Management intends to purchase up to $15 million worth of units in the offering. At $10 per unit, Live Oak Acquisition II would command a market value of $250 million.

SPACs Soar as Fast, Hassle-Free IPO Alternatives for Biotech Companies

2020/11/06

Special purpose acquisition companies (SPACs) are resurging as a virtually hassle-free alternative to initial public offerings (IPOs). They’ve been around for years, but are just now becoming a factor for biotech.

SPACs have been called blank check companies because there is no operating company and no business plan – only the intention to acquire or merge with an unidentified company within two years.

2020 BIO Investor Forum Digital: Why biotechs have been choosing SPACs in 2020

2020/11/05

This year has been a record year for Biotech initial public offerings (IPOs), with total deal value already up by 58% compared with all of 2019.

However, most recently there has been an unexpected surge in Special Purpose Acquisition Companies (SPACs) mergers and acquisitions (M&As) as a way of entering the public market during the Covid-19 pandemic compared with traditional IPOs.

Tech entrepreneurs’ SPAC Reinvent Technology Partners Z files for a $200 million IPO

2020/11/04

Reinvent Technology Partners Z, the second blank check company formed by Reinvent Capital targeting the tech sector, filed on Monday with the SEC to raise up to $200 million in an initial public offering.

The New York, NY-based company plans to raise $200 million by offering 20 million units at $10. Each unit consists of one share of common stock and one-fifth of a warrant, exercisable at $11.50. At the proposed deal size, Reinvent Technology Partners Z would command a market value of $250 million.

Technology-focused SPAC Benessere Capital Acquisition files for a $100 million IPO

2020/11/04

Benessere Capital Acquisition, a blank check company targeting middle market technology businesses in the Americas, filed on Tuesday with the SEC to raise up to $100 million in an initial public offering.

The Miami, FL-based company plans to raise $100 million by offering 10 million units at a price of $10. Each unit will consist of one share of common stock and one-half of a warrant, exercisable at $11.50. At the proposed deal size, Benessere Capital Acquisition will command a market value of $128 million.

SoftBank’s $100 Billion Vision Fund Loses COO, Four Partners

2020/11/03

SoftBank is grappling with an ongoing spate of resignations this year. Carolina Brochado gave her notice a month after she was promoted to partner. Vision Fund employees have described the company culture as one that rewards aggression and recklessness, Bloomberg Businessweek reported in December.

The SoftBank Vision Fund exits come as it continues to make bets on startups including fitness tracker Whoop and restaurant-technology maker Ordermark.

ChargePoint To Go Public In Another Signal Of Surge In EV Popularity

2020/11/03

Investors are paying attention to ChargePoint, Inc. One of the world’s first and largest electric vehicle (EV) charging networks, it has revealed that it will go public by merging with Switchback Energy Acquisition Corp. The deal will value the company at $2.4 billion.

Approximately $493 million in net proceeds will advance ChargePoint, Inc.’s commercial, fleet, and residential businesses. The deal is expected to close near the end of the year, and the company will be named ChargePoint Holdings Inc. No New York Stock Exchange trading symbol has yet been identified.

Lidar maker Aeva to go public via merger

2020/11/03

Aeva Inc., a Silicon Valley firm developing a lidar sensor for self-driving cars to perceive their surroundings, said Monday it has agreed to go public through a merger with spac InterPrivate Acquisition Corp.

The merger with InterPrivate, which values Aeva at more than $2.1 billion, will give it a cash injection of more than $300 million to develop sensors for phones, tablets and other consumer devices.

NYSE wins back listing crown from Nasdaq after luring Spacs

2020/11/03

The New York Stock Exchange is on track to steal back the crown for US stock market listings from its rival Nasdaq this year after tapping into the booming market for blank cheque companies.

Companies have raised $66bn through listings on NYSE this year compared with $61bn on Nasdaq, according to Dealogic, with nearly two-thirds of the proceeds raised on NYSE coming from Spacs.

7 Hot SPAC IPOs to Buy Before Election Day

2020/11/03

Despite the recent stock market volatility, SPAC IPOs show no signs of slowing down. Here is a look at seven upcoming SPAC IPOs that investors can buy in the coming weeks and months:

– CarLotz

– XL Fleet

– Onyx Enterprises

– Skillz

– ChargePoint

– United Wholesale Mortgage

– Playboy

Ride the Trend of Bioplastics With This Upcoming SPAC Merger

2020/11/03

Ride the Trend of Bioplastics With This Upcoming SPAC Merger.

Hundreds of billions of pounds of plastic ends up in the world’s landfills and oceans every year, and most of it will stay there for thousands and thousands of years.

Eliminating that scourge will take more than reducing, reusing, and recycling.

Lordstown Motors: Can GM’s Old Plant Beat It?

2020/11/02

Lordstown Motors (NASDAQ:RIDE), housed in a former General Motors (NYSE:GM) assembly plant, has begun trading with a market capitalization of $460 million. RIDE stock opened Oct. 29 at about $14.50 per share.

It’s all part of a frenzy of electric-car financing, as investors continue to reject the old gas-powered giants and search for someone who might compete with Tesla (NASDAQ:TSLA). Nikola (NASDAQ:NKLA) went public earlier and is now part-owned by GM. A company called Fisker is also trying to go public through a SPAC.

Sports and entertainment SPAC Bull Horn Holdings prices $75 million IPO at $10

2020/11/02

Lordstown Motors (NASDAQ:RIDE), housed in a former General Motors (NYSE:GM) assembly plant, has begun trading with a market capitalization of $460 million. RIDE stock opened Oct. 29 at about $14.50 per share.

The company plans on targeting leading sports, entertainment, and brand companies that have potential for brand and commercial growth.